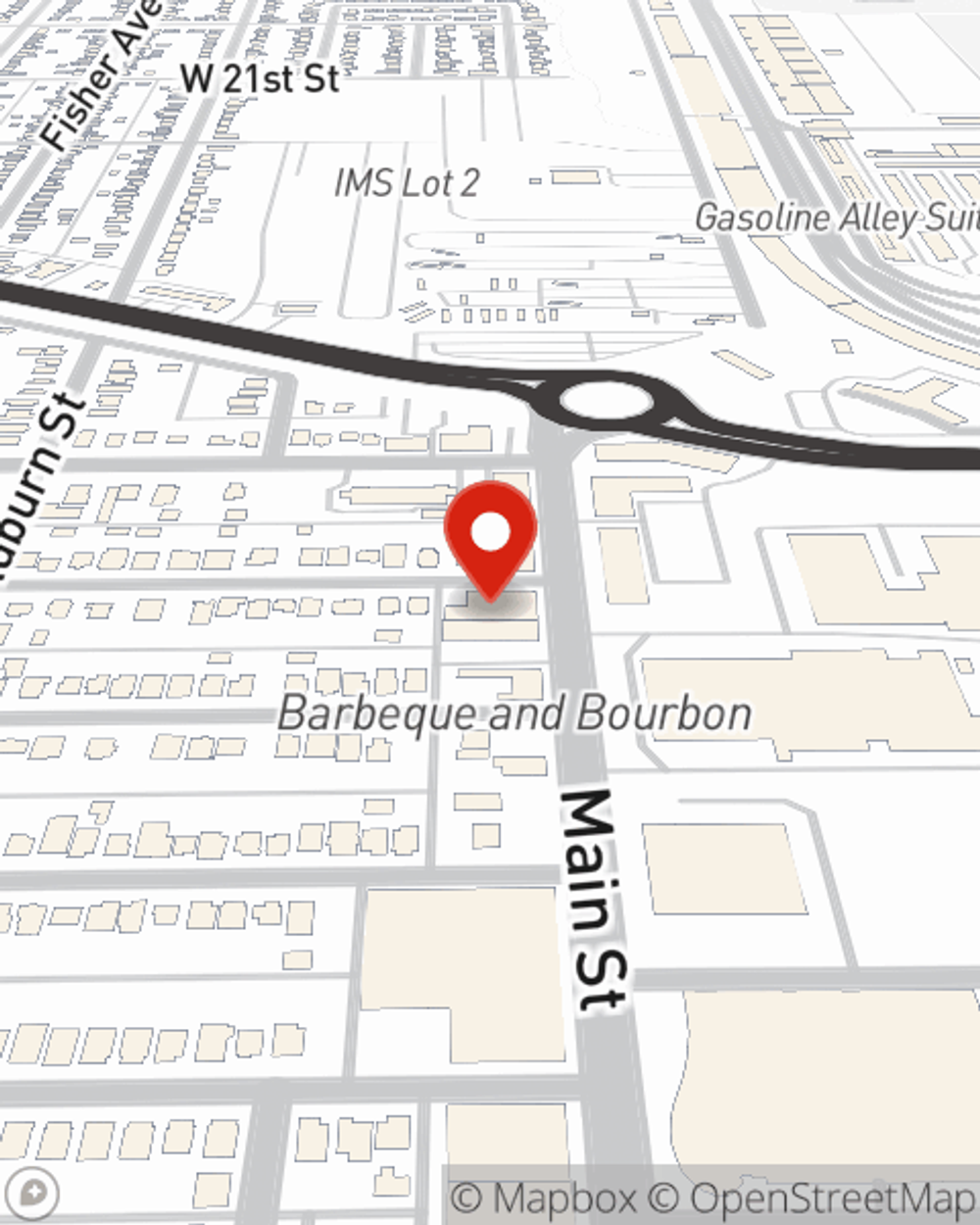

Business Insurance in and around Speedway

Looking for small business insurance coverage?

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

When you're a business owner, there's so much to consider. You're not alone. State Farm agent Brittany Wells is a business owner, too. Let Brittany Wells help you make sure that your business is properly protected. You won't regret it!

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Future With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your take-home pay, but also helps with regular payroll expenditures. You can also include liability, which is important coverage protecting your business in the event of a claim or judgment against you by a third party.

It's time to call or email State Farm agent Brittany Wells. You'll quickly uncover why State Farm is one of the leading providers of small business insurance.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Brittany Wells

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.